4 Easy Facts About Estate Planning Attorney Explained

Table of ContentsThe smart Trick of Estate Planning Attorney That Nobody is DiscussingEstate Planning Attorney - The FactsExcitement About Estate Planning AttorneyEstate Planning Attorney Things To Know Before You Buy

Your attorney will certainly additionally help you make your papers authorities, scheduling witnesses and notary public signatures as needed, so you do not need to fret regarding trying to do that final action on your very own - Estate Planning Attorney. Last, but not least, there is useful satisfaction in establishing a relationship with an estate preparation lawyer who can be there for you later onBasically, estate preparation attorneys provide worth in lots of ways, much beyond just supplying you with printed wills, trusts, or various other estate preparing records. If you have concerns about the procedure and intend to find out more, call our office today.

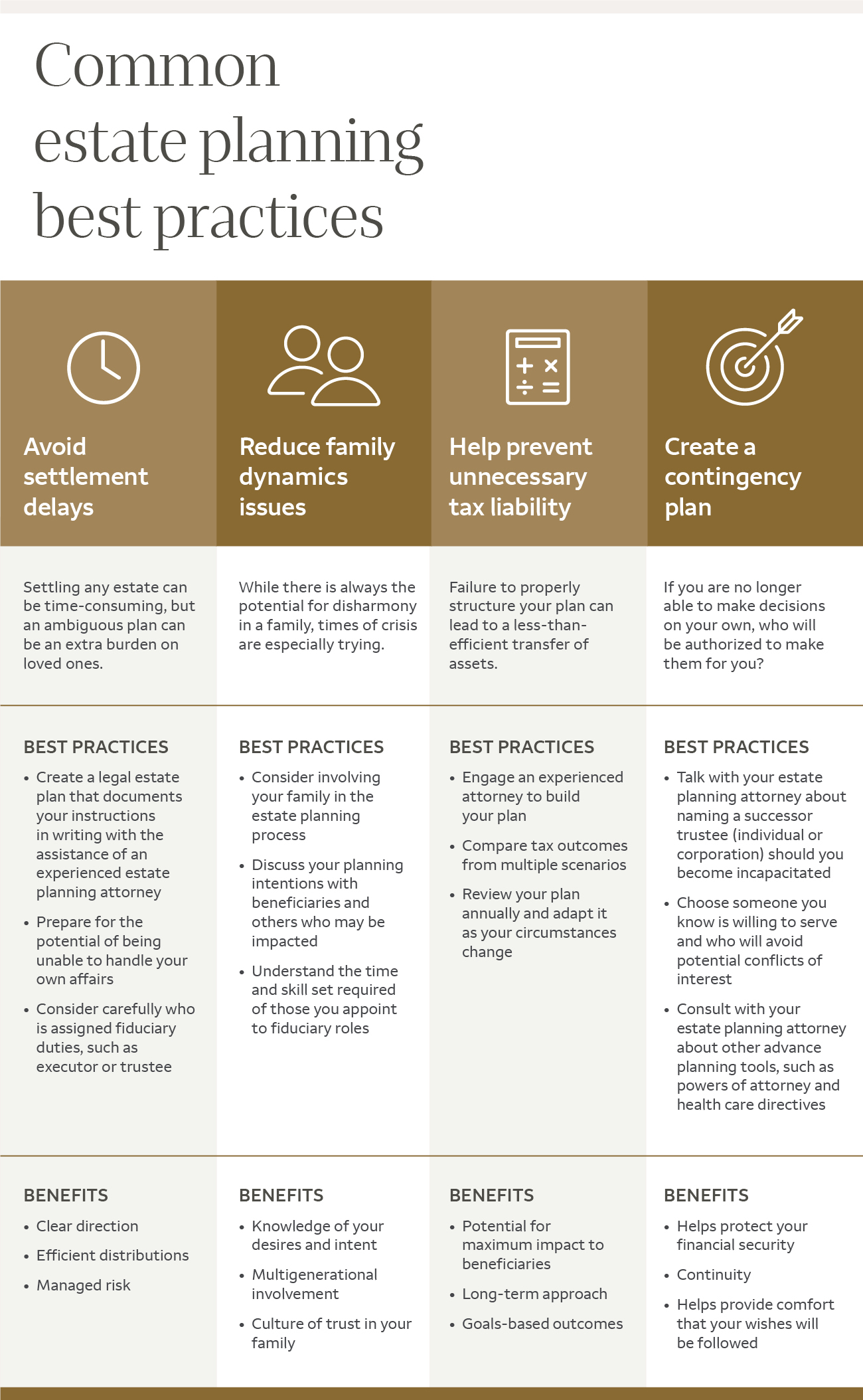

An estate preparation attorney aids you formalize end-of-life choices and legal records. They can establish wills, develop trusts, develop health treatment directives, establish power of lawyer, develop sequence plans, and more, according to your dreams. Collaborating with an estate preparation attorney to finish and oversee this lawful paperwork can assist you in the adhering to eight locations: Estate intending attorneys are professionals in your state's trust, probate, and tax legislations.

If you do not have a will, the state can choose just how to divide your possessions amongst your successors, which might not be according to your desires. An estate preparation lawyer can help organize all your legal records and disperse your assets as you want, possibly staying clear of probate. Many people draft estate planning files and afterwards forget about them.

Our Estate Planning Attorney Diaries

When a client passes away, an estate strategy would certainly determine the dispersal of possessions per the deceased's directions. Estate Planning Attorney. Without an estate strategy, these choices may be left to the near relative or the state. Duties of estate organizers consist of: Developing a last will and testimony Establishing trust accounts Calling an administrator and power of attorneys Identifying all beneficiaries Calling a guardian for minor children Paying all debts and decreasing all taxes and legal costs Crafting instructions for passing your values Developing choices for funeral setups Wrapping up instructions for treatment if you become unwell and are not able to make choices Obtaining life insurance policy, impairment revenue insurance policy, and long-lasting treatment insurance coverage An excellent estate plan should be upgraded routinely as customers' financial scenarios, personal inspirations, and federal and state regulations all develop

Just like any career, there are qualities and abilities that can help you attain these goals as you function with your customers in an estate planner duty. An estate planning profession can be right for you if you possess the adhering to characteristics: link Being an estate organizer means believing in the long-term.

Getting The Estate Planning Attorney To Work

You need to aid your customer anticipate his or her end of life and what will take place postmortem, while at the exact same time not home on morbid thoughts or emotions. Some clients might end up being bitter or anxious when pondering death and it might drop to you to aid them with it.

In case of fatality, you may be anticipated to have countless conversations and transactions with surviving household members concerning the estate strategy. In order to stand out as an estate planner, you might need to stroll a fine line of being a shoulder to lean on and the individual trusted to interact estate planning issues in a timely and professional way.

tax obligation code changed hundreds of times in the 10 years between 2001 and 2012. Anticipate that it has actually been altered additionally given that then. Depending upon your customer's financial earnings brace, which might evolve toward end-of-life, you as an estate coordinator will certainly need to maintain your customer's properties in full legal compliance with any kind of local, federal, or international tax regulations.

The Ultimate Guide To Estate Planning Attorney

Gaining this qualification from companies like the National Institute of Certified Estate Planners, Inc. can be a strong differentiator. Belonging to these expert teams can verify your abilities, making you extra appealing in the eyes of a prospective customer. In addition to the emotional reward helpful clients with end-of-life preparation, estate coordinators appreciate the advantages of a stable income.

Estate planning is a smart point to do no matter of your present health and monetary standing. The initial crucial point is to employ an estate preparation lawyer to assist you with it.

The percent of people that don't understand just how to get a will has increased from 4% to 7.6% considering that 2017. An experienced lawyer knows what information to include in the will, including your recipients and unique considerations. A will secures your household from loss due to immaturity or disqualification. It additionally offers the swiftest and most efficient technique to move your properties to your beneficiaries.